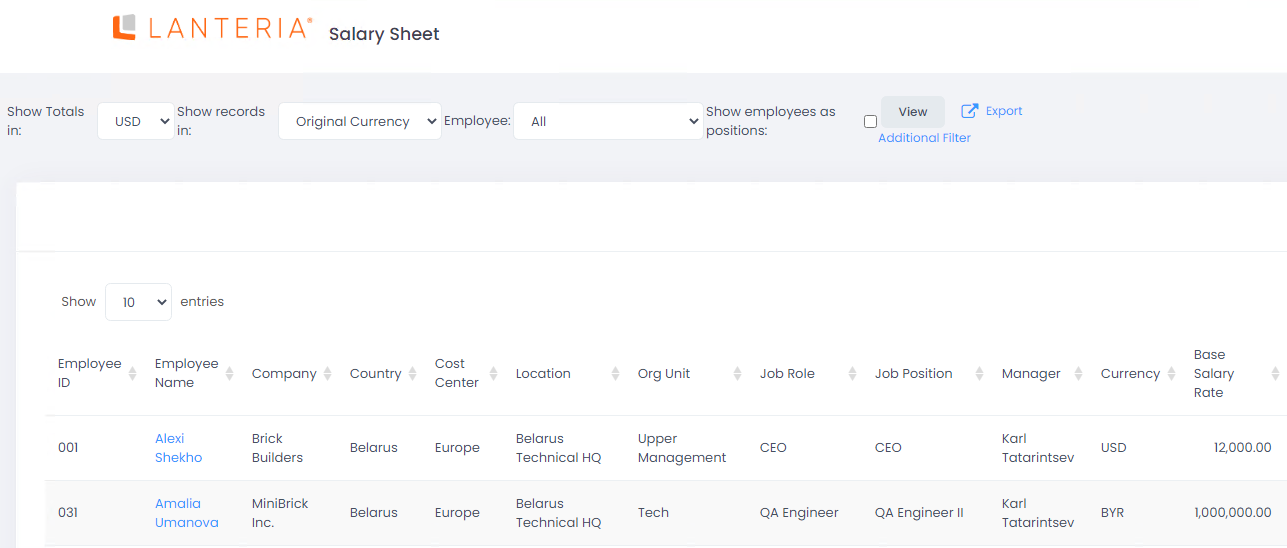

After the salary budgeting is done, you can proceed to planning the individual employee salaries. To do this, go to Compensation > Salary Sheet > Salary Sheet. Alternatively, you can click Reports > Report Center > Core HR > Salary Sheet.

Select a currency to show totals in as well as currency for records, set filters if necessary, and then click View.

The Salary Sheet contains a list of all the employees with their current salary settings defined when assigning the employee to position.

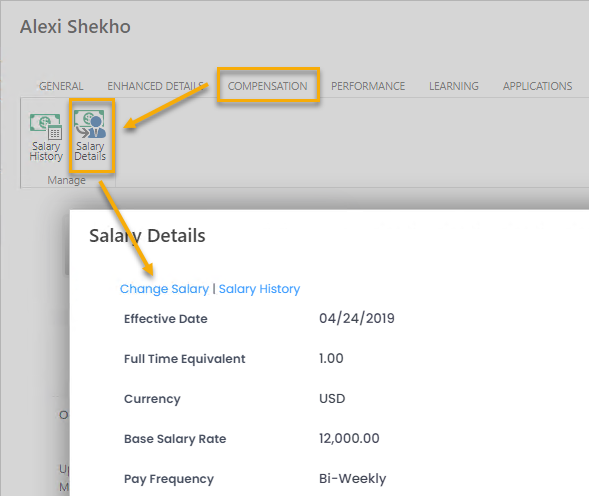

To specify or change salary for the employee, follow these steps:

- Go to Compensation > Salary Sheet > Salary Sheet.

- Click the name of the employee for whom the salary is to be changed. This will open the employee card.

- Go to the Compensation tab and click the Salary Details button.

- Click the Change Salary link.

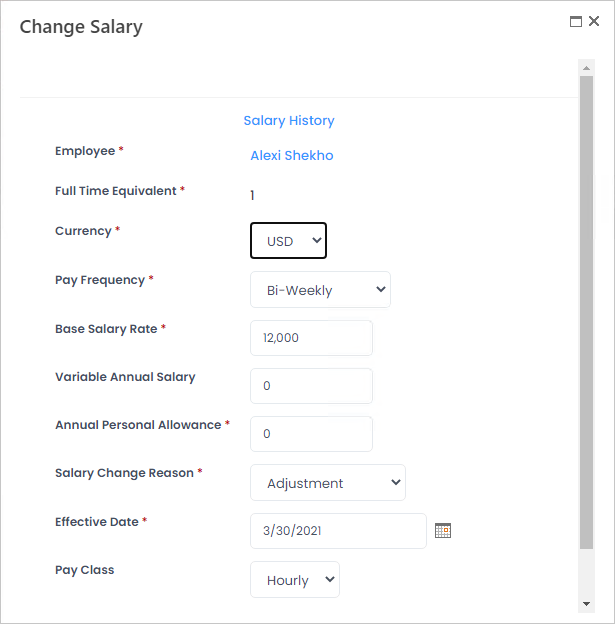

- In the Full Time Equivalent field, ensure that the correct FTE is specified. The salary will be planned for this FTE. in case the Hourly pay frequency is used (with other pay frequency options, the FTE is not used to calculate annual base salary).NoteYou cannot edit FTE from the Change Salary dialog window. To change the FTE, on the employee card, click Assign to Job Position and change the figure as necessary.

- Use the Add button to select the adjustment factors that will be applied to the employee's salary in the Salary Adjustment Factors field.

- Select the currency in which the salary will be paid from the drop-down list in the Currency field.

- Select the payment frequency for which the salary rate will be specified from the drop-down list in the Pay Frequency field.

- Hourly – The salary is paid every hour. This is the only pay frequency option where FTE is used in the calculation of the annual base salary. With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = FTE *Base Salary Rate * 2080 (irrespective of how many actual working hours or holidays the year has).

- Daily – The salary is paid on a daily basis. With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = Base Salary Rate * 260 (irrespective of how many actual working days or holidays the year has)

- Weekly – The salary is paid every week. With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = Base Salary Rate * 52

- Bi-Weekly – The salary is paid every two weeks. With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = Base Salary Rate * 26

- Semi-Monthly – The salary is paid every half-month (at the beginning and in the middle of a month). With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = Base Salary Rate * 24

- Monthly – The salary is paid every month. With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = Base Salary Rate * 12

- Yearly – The salary is paid once a year. With this pay frequency, the annual base salary (12 months) is calculated as follows: Annual Base Salary (12 months) = Base Salary Rate * 1

- Enter the employee base salary (without bonuses and additional payments) per period selected in the Pay Frequency field into the Base Salary Rate field.

- If the employee is entitled to some personal additional payment, specify the amount of such payment per year in the Annual Personal Allowance field.

- Select the reason of the salary change from the drop-down list in the Salary Change Reason field.

- Enter the notes into the Notes field, if necessary.

- Enter the date when the new salary becomes effective into the Effective Date field.

- Enter the variable annual salary amount into the Variable Annual Salary field.

- Select the payment type from the drop-down list in the Pay Class field. This field is for information purposes only and it does not affect salary calculations. You can select one of the following pay classes:

- Salary – The employee's salary is based on a fixed base salary rate, which is paid with the agreed frequency irrespective of how many billable hours the employee actually spent on work. The automatic calculations in the salary details, such as annual base salary or annual total fixed cash, are designed for this pay class.

- Hourly – The employee's salary is based on an agreed hourly rate, and the employee gets paid only for billable hours actually spent on work.

- Click Save.

All the sums payable to the employee comprise the Annual Total Fixed Cash, that is, total amount of money to be paid to the employee per year, not counting individual bonuses. It includes:

- Annual Base Salary (12 months) – calculated as base salary rate multiplied by the number, based on pay frequency (see the description of the Pay Frequency field for details).

- Variable Annual Salary – additional payment that can be added to the salary based on the employee's performance

- Annual Fixed Position Bonuses – specified at the position level

- Annual Country Pension – if the organizational unit the employee belongs to is located in the country for which the remuneration rules are set up, the remuneration amount will be calculated and added to the employee's salary

- Extra Months Payment - if the organizational unit the employee belongs to is located in the country for which the Annual Months of Pay are more than 12, the extra months payment will be calculated based on the employee salary per month and the number of additional months payable

- Annual Personal Allowances – individual employee allowance

- Compensation Adjustment – the list of the Adjustment factors that are assigned to the employee

- Total Annual Compensation Adjustment – adjustment calculated based on the adjustment factors

- Annual Business Trip Allowance – additional sum of money that can be spent on business trips

- Additional Salary Amount – additional sum of money on other needsNoteThe Additional Salary Amount is a calculated field that can be used for adding some amount to the employee annual salary based on your own formula. For example, the Sales Managers in your company get salary supplement, which is calculated as some additional amount * employee Full Time Equivalent. To include this payment into the Annual Total Fixed Cash, we create a new field Salary Supplement in the Employee Salary Details list, where the amount can be specified for the corresponding employees by clicking Change Salary on the employee card (the newly created field is automatically added to this page). We also add formula to the Additional Salary Amount: Salary Supplement * FTE. The Additional Salary Amount will be calculated for the employees with the specified Salary Supplement and will be automatically added to the Annual Total Fixed Cash. The Salary Supplement and Additional Salary Amount will be displayed on the Salary Sheet. However, to have these fields displayed on the employee Salary Details page, the assistance of Lanteria HR support engineer will be needed.

- Annual Total Fixed Cash – the total sum that is to be paid to the employee

To view the salary sheet totals in another currency, select it in the Show Totals in field of the filter section and click View.

If you want to view the employee salary records in the selected currency, select it from the drop-down list in the Show records in field or select Original Currency option in this field.

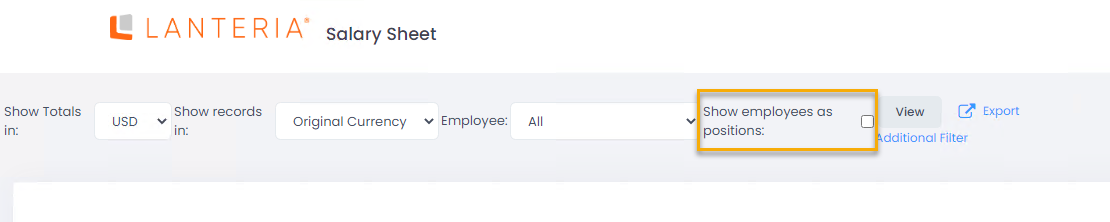

If your company uses multiple job assignment, select the Show employees as positions check box to display individual salary records for each employee position.

Compa Ratio

On the salary sheet, in the Compa Ratio field, for each employee, you can see the compa ratio – competitiva ratio of the salary. The formula commonly used by compensation professionals to assess the competitiveness of an employee's pay level involves calculation of compa-ratio. Compa-ratio is calculated as the employee's current salary divided by the current market rate (also referred to as midpoint) as defined by the company's competitive pay policy. Compa-Ratios are job position specific. A Compa-Ratio of 1.00 or 100% means that the employee is paid exactly what the industry average pays and is at the midpoint for the salary range. A ratio of 0.75 means that the employee is paid 25% below the industry average and is at the risk of seeking employment with competitors at a higher pay that is perceived equitable. A ratio of 1.15 compa-ratio would mean the employee is paid above the industry average.

In Lanteria HR, compa-ratio is calculated as follows:

Compa Ratio = Employee Annual Base Salary / Midpoint where Midpoint is calculated as follows:

Midpoint = Job Position Salary / Job Position Currency Rate * Employee Salary Rate