If some of your employees are entitled to additional compensation due to working in some particular country, set up country remuneration rules. You can specify this amount as a percent of the employee salary capped at a certain maximum amount.

If there are several country remuneration rules for a particular country, then the due payments for every rule are calculated and added to the total compensation amount displayed in the Country Pension field of the employee salary sheet.

Follow these steps to set up remuneration rules:

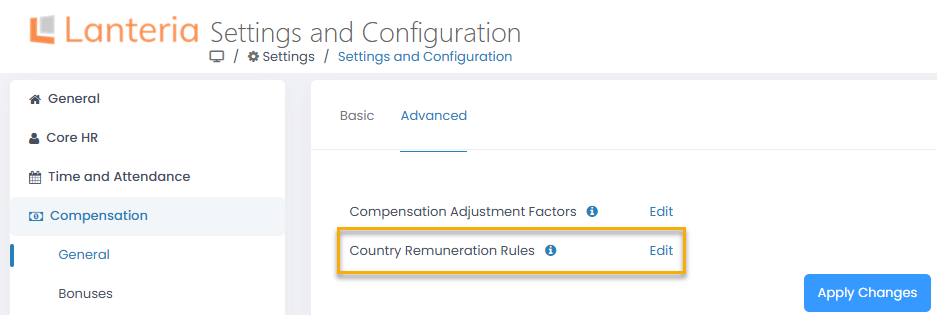

- Go to Settings > Settings and Configuration > Compensation.

- Click General in the left panel and click Edit next to the Country Remuneration Rules setting name on the Advanced tab.

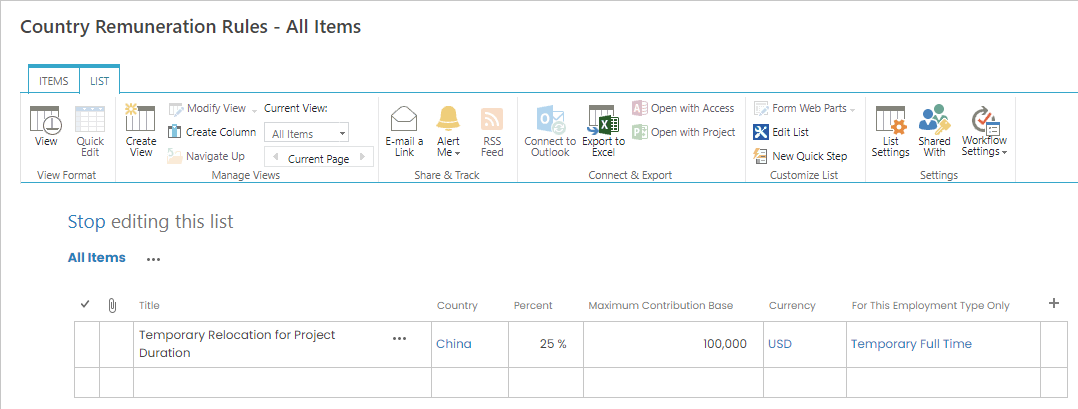

- The Country Remuneration Rules list will open in spreadsheet view where you can directly edit the information you need

- Enter the rule name into the Title column.

- Select the country where the rule should be applied from the drop-down list in the Country column.

- Enter the percentage for additional payment into the Percent column.

- Enter the maximum amount that can be added to the employee salary according to this rule into the Maximum Contribution Base column.

- Select the currency the maximum contribution base is specified in from the drop-down list in the Currency column.

- If the rule is to be applied only for particular employment types, select the relevant check boxes in the drop-down list in the For this Employment Type Only column.

- Another way of editing a country remuneration rule is to either click on the rule name or select Edit Item from the list item menu.

This will open the rule details form in the edit view where you can make all the necessary modifications..png)

Country remuneration rules are applied to all employees from a particular country as defined by the organizational unit the employee is assigned to. The additional payment amount can be viewed in the Country Pension field of the employee salary sheet or personal employee card.